Principal Global Investors recently issued the following announcement.

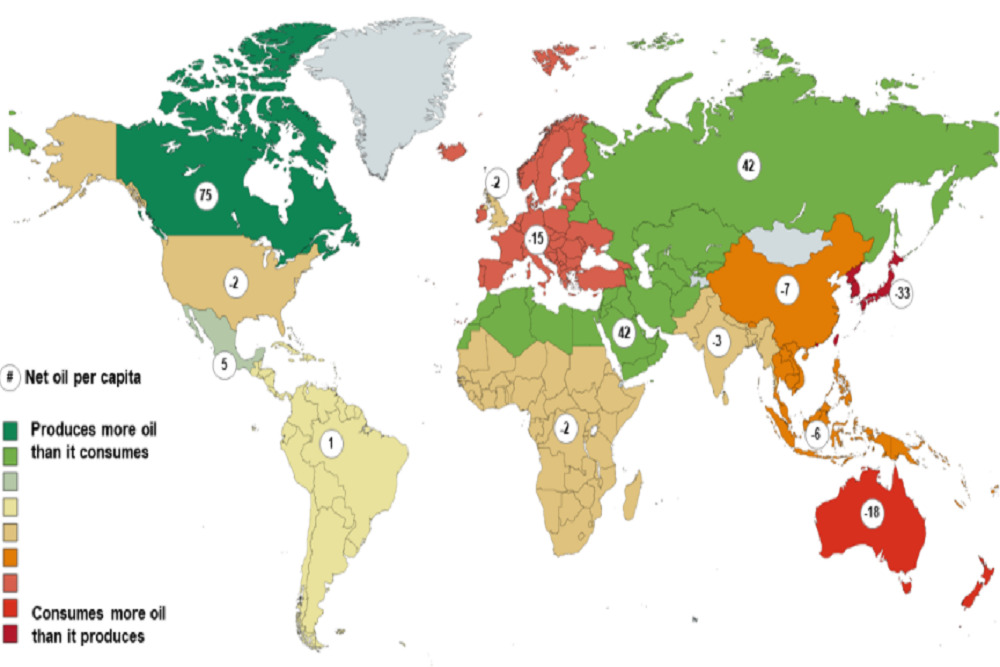

Geopolitical tensions in eastern Europe have ratcheted up during the past few weeks, and a global oil standoff is in the crosshairs. If the conflict with Ukraine escalates, Russia could weaponize its energy exports, with significant economic fallout:

- For starters, global energy supplies are already low. This renders energy prices vulnerable to any kind of shock.

- With inflation elevated, a rise in energy prices would further antagonize central banks.

- Following pandemic stimulus, consumer savings rates have normalized for the lower income bracket. Since lower-income consumers have a higher marginal propensity to spend, a further inflation "tax" would crimp economic activity.

By contrast, production and consumption in the U.S. are more balanced, so economic activity may be relatively more resilient to an energy shock. But make no mistake, although energy producers might benefit from an increase in prices, the impact on U.S. industries and, therefore, consumers could be significant. On balance, given Europe's greater vulnerabilities, we take a non-consensus preference to U.S. over Europe. Globally, however, safeguarding portfolio value against this potential energy shock will be imperative.

Original source can be found here.

Alerts Sign-up

Alerts Sign-up