Principal Global Investors recently issued the following announcement.

January marked the worst start to the year for the S&P 500 since the Global Financial Crisis, as investors responded to the United States Federal Reserve's (Fed) tightening plans. While equities often react poorly to sharp changes in the policy environment, provided tightening expectations aren't too onerous and the economy is growing, the period of adjustment is often temporary.

Much of investors' concern is focused on the five Fed hikes that markets are pricing in for 2022, and if they won't be sufficient to contain inflation. Yet, the Fed's urgency to tighten should soon ease as the most acute economic price pressures start fading. Furthermore, while U.S. growth has likely peaked, a recession isn't in the cards. Corporate profits are the strongest in decades, consumers are backed by excess savings, and gradual supply chain normalization should provide a boost to inventories and production.

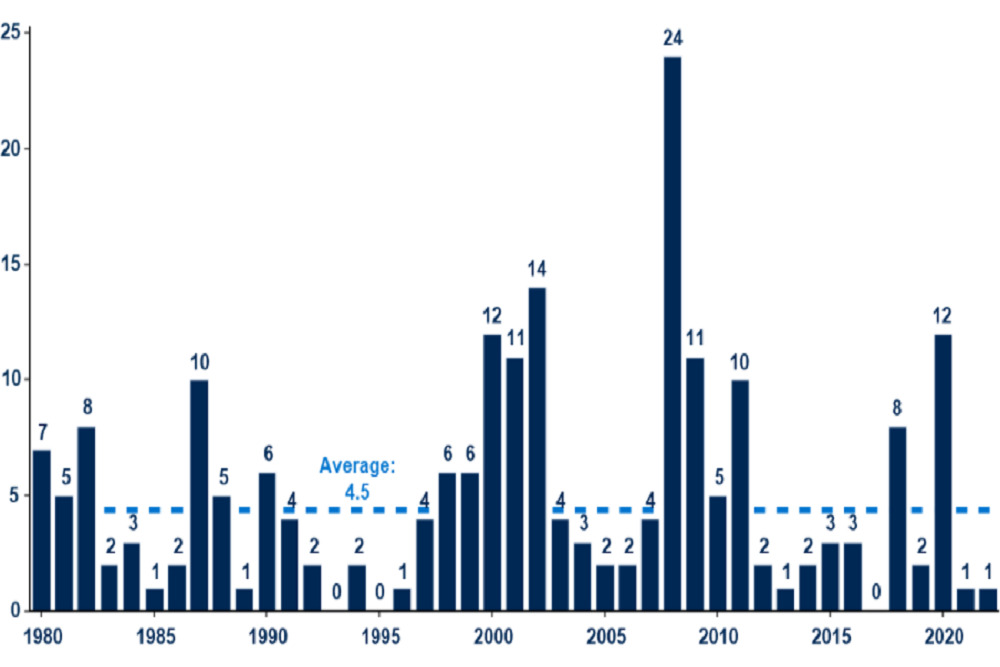

The S&P 500 being down over 5% year-to-date may seem significant after quarters of relative calm. However, it is fairly standard market behavior as there are typically four or five pullbacks of 5% or larger each year. With the backdrop for risk assets still supportive, expect equity returns to be positive this year, although likely lower and with more normal volatility.

Original source can be found here.

Alerts Sign-up

Alerts Sign-up